Governance Surveys

Directorship Magazine

2024 Governance Outlook

Director Outlook: Top Priorities for 2024

Economic volatility, technology changes, and talent concerns continue to be top of mind for directors as we head into 2024, based on the results of the National Association of Corporate Directors’ (NACD) annual Board Trends and Priorities Survey. More than 500 directors responded to the annual survey, and the results build on insights captured through our quarterly Directors’ Pulse Surveys. Taken together, the research tracks how the boardroom is responding to rapid developments in the business environment.

TOP TRENDS

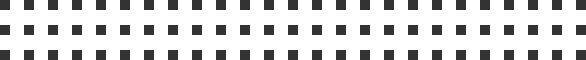

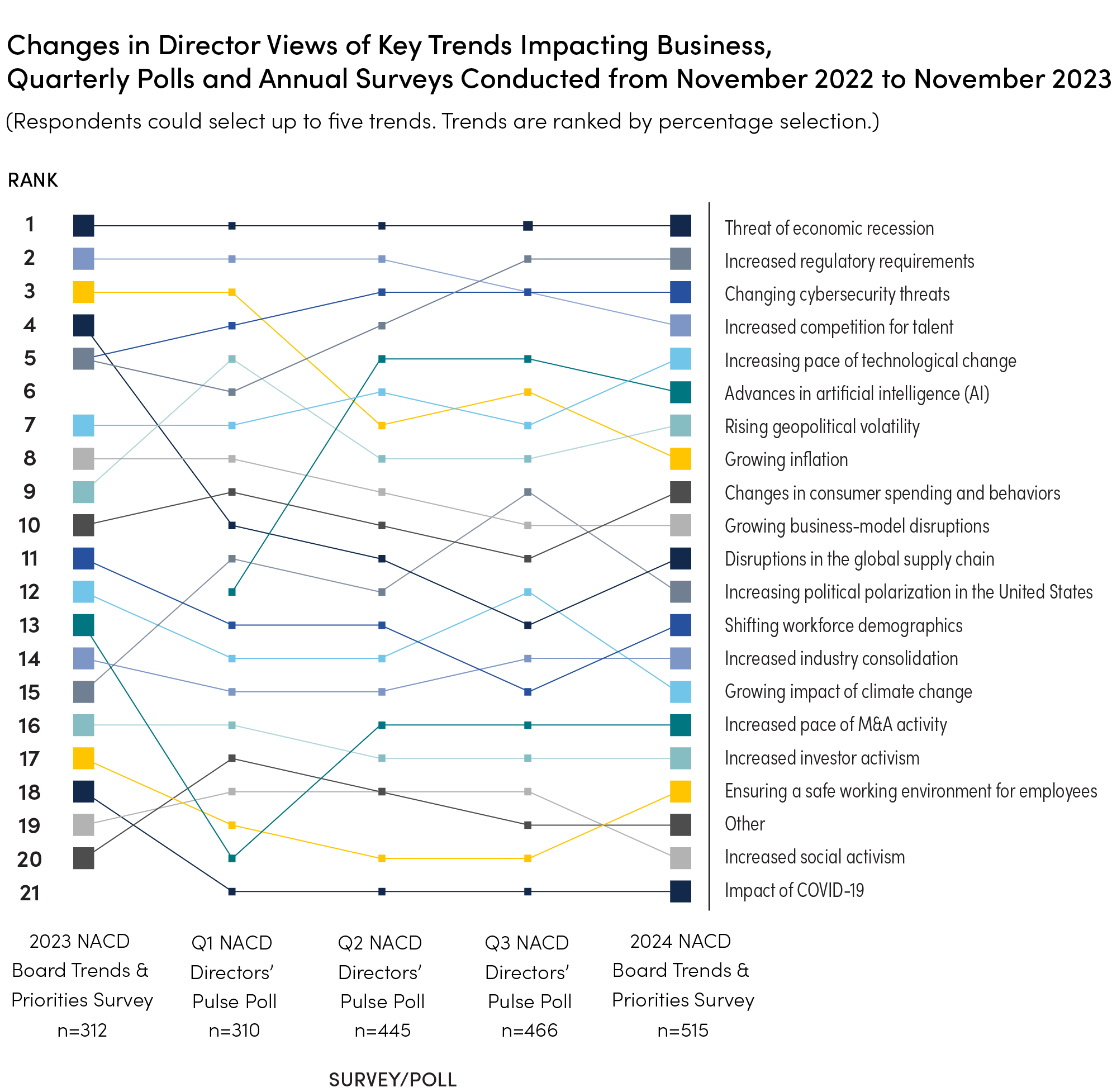

Directors were asked to select the top five trends that they believe will have the greatest effect on their company over the next year. Slightly more than half of respondents (50.1%) included the threat of an economic recession among their top five trends for 2024. This has consistently remained the top-ranked issue in our quarterly polls throughout the year. Nevertheless, the percentage of respondents selecting the “threat of economic recession” has decreased relative to last year’s Trends Survey data, when it was selected by nearly two-thirds (64%) of respondents.

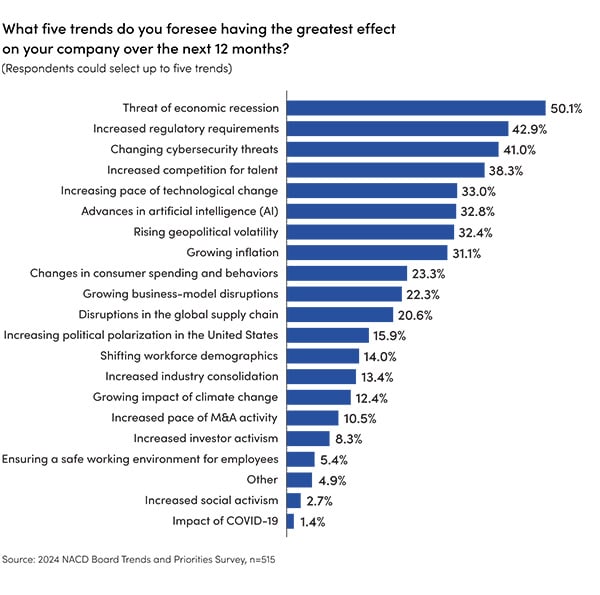

Directors’ outlook on the economy has improved relative to last year. Last year, only 29 percent of respondents anticipated that the United States’ economy was heading for a “soft landing,” by mid-2023. This year, 62 percent of respondents feel that we are heading for a “soft landing.” There have also been decreases in the percentages of those that anticipate a recession (from 65% to 29%), or a severe recession (from 6% to 2.5%). Whether the economy falls into a recession or not, the very threat of a recession has a direct implication for company strategy development and budgeting and planning for 2024.

The second most selected trend was “Increased regulatory requirements.” This trend has steadily proceeded up directors’ priority lists. After ranking sixth in the first quarter and fourth in the Q2 poll, it rose to the second most selected trend in Q3. Respondents cited several different specific regulations that motivated their inclusion of this issue in their top five. Many were industry specific. For example, 14 percent indicated that regulations or potential regulations affecting the banking industry are top of mind. Many in the industry expect new regulations following the high-profile failure of three banks earlier this year.

Outside of industry-specific concerns, a major theme was regulatory action related to climate change. Across the year, there have been developments at both the state and federal level. At the state level, two landmark climate-related disclosure bills were passed in California in September 2023. The Climate Corporate Data Accountability Act relates to emissions disclosures, and the Climate Related Financial Risk Act requires the disclosure of certain climate-related financial risks. Thousands of companies doing business in California are expected to be impacted by these regulations by 2026.1 Meanwhile, at the federal level, companies anticipate that the SEC will finalize last year’s proposed ruling on climate-related reporting for publicly traded companies.

It is worth noting that many of the trends interact and amplify each other. Boards should therefore anticipate the cascading second- and third-order effects of these trends. For example, growing geopolitical conflicts are increasing the risk of a global economic recession and potential supply chain disruptions. Another example, and the third most selected issue, is “Changing cybersecurity threats.” Cybersecurity concerns are associated with two other widely selected trends: the general “Increased pace of technological change,” and, more specifically, “Advances in artificial intelligence.” Respondents’ open-ended question responses illustrate specific concerns. “Threat actors are using AI and continuing to refine targeted attacks against company assets and their people,” notes one respondent. “As AI and digital transformation increase, that goes hand in hand with cyber risks,” advises another.

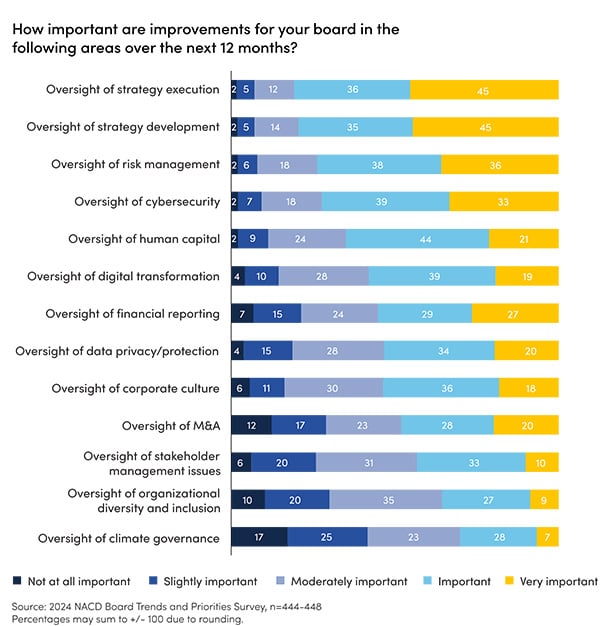

The “Increasing pace of technological change” is a persistent concern for directors. This was the fifth most selected issue, with 33 percent of respondents including it in their top five. While they need not be experts, directors must remain well informed about the implications of major technological developments to provide adequate oversight of their company’s strategy and risks. In fact, 58 percent of respondents indicated that it was “important” or “very important” that their board improve regarding the “Oversight of digital transformation.” Even higher percentages of directors believe that their board must improve its oversight of strategy development and execution. This is one of the most crucial roles of the board, and has become more challenging at a time of major disruption.

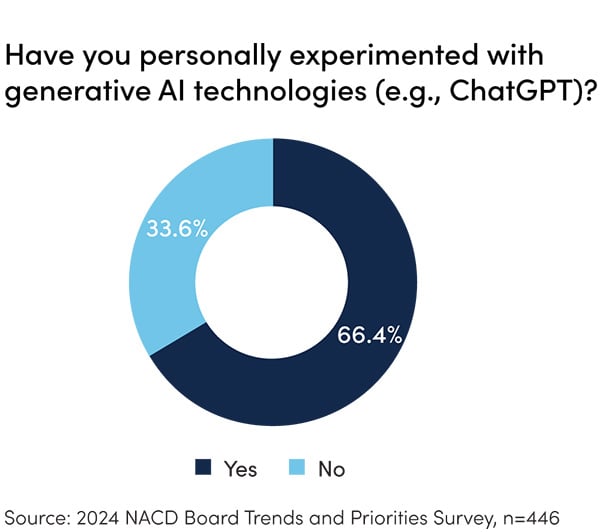

Perhaps nothing exemplifies the disruptive potential of technology quite as well as recent advancements in artificial intelligence. This issue did not feature on last year’s list of top trends, but it was introduced in NACD’s Q1 2023 Directors’ Pulse Poll, and rose rapidly from the 12th most selected issue, to among the overall top five most selected. The growing focus on artificial intelligence can be traced back to November of 2022, when OpenAI released ChatGPT. This tool is an example of generative AI, a technology that leverages vast amounts of data and statistical modeling to produce output ranging from creative prose to computer code. Many quickly saw the potential for business to harness this technology to drive efficiencies or better serve customers. Directors, too, have seen this potential. In fact, nearly two thirds (66%) of respondents indicated that they have experimented with generative AI technologies.

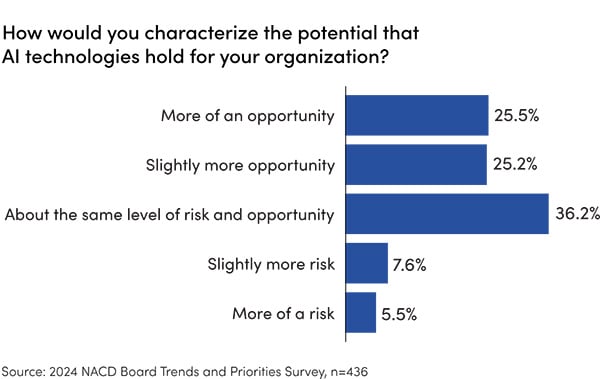

Respondents’ opinions about the prospects of these technologies are mixed. One respondent cautions, “This new technology is being implemented without fully understanding the full implications.” Others seem more eager to take advantage of its potential. One such respondent indicated that, at their organization, the technology was “likely to be deployed rapidly to address productivity issues.” Regarding the potential that AI technologies hold for their own businesses, about a third believe they present approximately the same amount of risk and opportunity. The general sentiment seems more optimistic, however, with more than half (51%) of respondents indicating that AI presents more opportunities than risks to their organizations.

Among the calculated risks and opportunities to be evaluated when adopting artificial intelligence technologies will be the impact on the workforce and recruiting efforts. Only 17 percent of respondents indicated that they had asked management about how AI could affect the company’s recruiting efforts and future workforce needs. This may be a significant oversight, particularly given that the fourth most selected item in the overall top five for this year was the “Increased competition for talent.” While this issue remains in the top five, it has steadily declined from its position as the second most selected issue across the second half of the year. But the challenges in securing a futureskilled workforce remains. Several open-ended responses cited the need for more “tech-savvy,” “specialized,” or “skilled” workers. One director’s response was particularly illustrative of the relationships between these trends: “Talent is getting harder to get; we’re not educating the new workforce fast enough. Workers that learn how to efficiently use AI will bring an enormous advantage.”

CONCLUSION

This year’s NACD Board Trends and Priorities Survey, along with NACD’s quarterly Directors’ Pulse Polls across the year, have shown the broad spectrum of urgent issues that are confronting boards. In our article for last year’s Governance Outlook Report, we noted that every year there are specific new trends that drive changes to board agendas and governance practices. That the survey informing last year’s article was in the field mere weeks before the launch of ChatGPT only helps to illustrate and emphasize this point. Directors, to be successful in their expanding role today, must be prepared to learn more and learn faster.

NOTES:

1 See Alejandro Lazo, “Newsom signs climate bills that force large companies to reveal role and risks in climate change,” posted on CalMatters.org on Sept. 12, 2023, and updated on Oct. 7, 2023.

Ted Sikora is NACD’s senior project manager, Surveys and Business Analytics. He specializes in questionnaire design, data analysis, and data visualization, and is responsible for generating quantitative insights that serve to elevate board performance.

Discover More